Employer Support Payment

Employer Support Payments of up to $15,000 are available to eligible employers who hire an eligible unemployed Queenslander in regional or South East Queensland.

About the Back to Work program

The Back to Work program is designed to give businesses the confidence to employ Queenslanders who have experienced a period of unemployment. Support payments are available to eligible employers who hire a previously unemployed Queenslander who has experienced a minimum period of unemployment directly prior to commencing work with them.

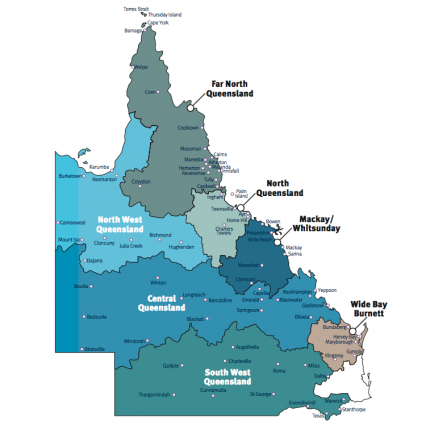

The program is available throughout regional Queensland and in some areas of South East Queensland (SEQ).

Employer Support Payments are available to eligible employers who meet all the program eligibility criteria.

The program is not a wage subsidy. The decision to employ someone is at the discretion of the employer and must be a business decision that is independent of the availability of the Back to Work support payment.

Employers can make an online application through QGrants after the eligible employee completes four weeks of continuous paid employment. Initial applications must be received within eight weeks of the employee completing four weeks of continuous employment.

Where is the program delivered?

Where is the program not available?

The Back to Work program is not available in the following local government areas:

- Brisbane

- Gold Coast

- Noosa

- Redlands

- Sunshine Coast

- Toowoomba

What payments are available?

From 15 July 2020, each eligible employer (based on their ABN) may claim a maximum of four Back to Work Regional applications and four Back to Work SEQ applications. This cap does not apply to applications for employees commencing before 1 July 2017 and does include applications from this date to 14 July 2020. This cap applies to Employer Support Payments and Boost Payments and combinations of those payment types. Once a total of four initial payment applications have been approved, no further initial payment applications will be accepted.

This payment information below is specific to Employer Support Payments. Back to Work payments are also available for eligible apprentices and trainees and for eligible employees aged between 15 – 24 years.

Regional

Employer Support Payments ($10,000)

For a jobseeker (aged 25 years or over) previously unemployed between four and 52 weeks

Payments are made directly to the eligible employer, in three parts:

- Initial payment of $3000 after four weeks of continuous employment and approval of the initial payment application.

- Second payment of $3500 after 26 weeks of continuous employment with the same employer and approval of the second payment claim.

- Final payment of $3500 after 52 weeks of continuous employment with the same employer and approval of the final payment claim.

Employer Support Payments ($15,000)

For a jobseeker (aged 25 years or over) previously unemployed 52 weeks or more

Payments are made directly to the eligible employer, in three parts:

- Initial payment of $4500 after four weeks of continuous employment and approval of the initial payment application.

- Second payment of $5250 after 26 weeks of continuous employment and approval of the second payment claim.

- Final payment of $5250 after 52 weeks of continuous employment with the same employer and approval of the final payment claim.

South East Queensland

Employer Support Payments ($15,000)

For a jobseeker (aged 25 years or over) previously unemployed 52 weeks or more

Payments are made directly to the eligible employer, in three parts:

- Initial payment of $4,500 after four weeks of continuous employment and approval of the initial payment application.

- Second payment of $5,250 after 26 weeks of continuous employment with the same employer and approval of the second payment claim.

- Final payment of $5,250 on completion of 52 weeks of continuous employment with the same employer and approval of the final payment claim.

NOTE: Claims cannot be made for second or final payments (later payments) unless there is an approved initial payment application for that employee lodged by the same employer and approved.

Pro-rata payments are not available for employment less than the required continuous employment period.

Employers are only eligible to receive one payment type per eligible employee.

The figures in this table are payments for eligible full-time jobs. Eligible part-time jobs attract 75 per cent of the full payment. Further information can be found in Eligible Jobs below.

Who can apply?

All employers are eligible except for government entities (local, State and Australian Governments and entities including government-owned corporations and statutory bodies).

Each eligible employer (based on thier ABN) may claim a maximum of four Back to Work applications. This cap of four applications applies to Employer Support Payments, Boost payments and combinations of these payment types.

Employers must:

- be compliant with workplace health and safety, industrial relations and taxation legislation and

- demonstrate a genuine commitment to ongoing employment of the employee.

Applicants will be entering into a legal agreement with the Queensland Government. Applicants will need to confirm, for each application submitted, that they:

- have read and understood the Guidelines and Terms and Conditions and

- consent to the Privacy Collection Notice detailed within the Back to Work Terms and Conditions. Specifically authorising the Back to Work Team to share information with Queensland and Australian Government agencies including but not limited to the Department of Employment, Small Business and Training, Office of State Revenue; Queensland Treasury; Office of Industrial Relations; Department of State Development, Tourism and Innovation; Queensland Ombudsman; Queensland Police Service; Department of Education; TAFE Queensland; Queensland Audit Office; WorkCover Queensland; Australian Taxation Office; Fair Work Ombudsman; Australian Government Department of Education, Skills and Employment and Centrelink. This is for the purposes of:

- evaluating, administering, assessing, monitoring and auditing compliance with the eligibility criteria for the Back to Work Program

- supporting the delivery of other Back to Work funding and support

- promoting the Back to Work Program

- have sought and obtained the consent of the employee (see Evidence requirements) referred to in the application to disclose the personal details of the employee for the purposes set out in the privacy statement contained in the Terms and Conditions and

- are committed to ongoing employment of the employee and

- that the employer and its office holders are compliant, and will continue to comply, with all local, state and Australian Government laws and regulations, including, but not limited to, industrial relations and taxation (including superannuation) legislation and

- that the information they have provided is correct and they have not provided false or misleading information within the application.

-

All eligibility criteria must be met in order to receive a Back to Work payment.

It is the responsibility of the applicant to ensure that the information provided in the application is true and correct. If the Back to Work Team becomes aware of any matter and determines that the eligibility criteria has not been met, repayment of the funds may be required.

Applications must be made by the employer, not an agent or other party. This is because the employer needs to agree to the terms and conditions of the Back to Work Program.

Regional

An eligible job must be mainly located in regional Queensland (excluding South East Queensland).

South East Queensland

An eligible job must be mainly located in a South East Queensland LGA as listed above.

An eligible job must be mainly located in the areas of Queensland listed under the Where is the program delivered? above, and either:

- Ongoing paid full-time (at least 35 hours per week on average) or

- Ongoing paid part-time (at least 20 hours per week on average) or

- For a person with a disability who has a workplace assessment to work between 8 and 20 hours per week, hours consistent with their approved benchmark, on average or

- A registered and eligible Queensland full-time or part-time apprenticeship (refer to Ineligible Apprenticeships below).

Ineligible jobs under Back to Work include:

- A casual job (i.e. may not have guaranteed hours of work each week; may involve working irregular hours; does not provide paid sick or annual leave). Further information can be found at https://www.fairwork.gov.au/employee-entitlements/types-of-employees/casual-part-time-and-full-time/casual-employees.

- Periodic employment such as engagements that are short-term in nature (e.g. weekly hire basis).

- Employees transitioning from casual or periodic employment to ongoing part-time or ongoing full-time work

- Where the applicant is not directly employing the employee (i.e. employed on contract via a third party, such as a labour hire company or group training organisation).

- A job that offers full-time salary or wages above $120,000 per annum (or pro-rata for part‑time).

Ineligible apprenticeships under Back to Work include:

- A school-based apprenticeship or traineeship

- An apprenticeship or traineeship which is funded through the Queensland Government’s Skilling Queenslanders for Work program.

An eligible employee for the Employer Support Payment:

- must be a permanent resident of Australia and their principal place of residency is in Queensland

- must have been unemployed for the minimum period of employment for the specified support payment directly prior to commencing employment with the eligible employer

- must not have worked for the eligible employer in the 52 weeks directly prior to commencing employment with the eligible employer

- commenced employment with the eligible employer during the relevant program (Back to Work Regional or Back to Work SEQ) eligibility period

- at the time the initial payment application is made, has been in paid employment with the eligible employer for at least four weeks but not more than 12 weeks

- is not a current full-time student

- was not a full-time student within four weeks directly prior to commencing employment with the eligible employer

- must not have displaced any existing workers and

- if the employee has a disability, must be engaged in mainstream employment.

An ineligible employee for a Back to Work payment includes if the employee is:

- an owner of the company, business or joint venture

- a sole trader

- a partner in a partnership

- a director of the company

- a significant shareholder in the company

- an owner under a trust arrangement. This may include the trustee, a beneficiary under the trust and/or being an owner of a directly controlled or related entity.

Initial payment applications must be received within eight weeks of the employee completing four weeks of continuous employment.

Eligible employees can be employed up to and including 30 June 2021. Applicants may continue to make online applications after 30 June 2021, as long as the applications submitted are within the eight weeks of the employee completing four weeks continuous employment.

These applications will be assessed under the Back to Work Guidelines for Funding 2020-21.

Later payment applications must be received within 12 weeks of the employee completing:

- 26 weeks of continuous employment for the second Employer Support Payment, Apprentice and Trainee Boost Payment or Youth Boost Payment

- 52 weeks of continuous employment for the final Employer Support Payment, Apprentice and Trainee Boost Payment or Youth Boost Payment

Applications and claims received outside of these timeframes will be ineligible for payment. It is highly recommended that applicants submit their applications well before the cut-off date.

If your initial application was approved under the Back to Work Guidelines for Funding 2020-21, your later payment claims will continue to be assessed under these guidelines as they become due in the 2021-22 financial year.

Applicants must notify the Back to Work Team immediately of any problems submitting their applications within the required timeframe.

Consideration will be given to a late application if:

a) the applicant has experienced extenuating circumstances beyond their control (e.g. ill health, loss of records due to natural disaster or a large scale Internet failure) that prevented the submission of an application within the required timeframe and

b) the Back to Work Team has been notified as required in the How long do employers have to apply for a Back to Work payment? section above.

A written request for consideration of a late application including a statutory declaration, together with all relevant material must be submitted to the Back to Work Team.

Please note that being unaware of the Back to Work program and not submitting an application within the required timeframe is not considered an extenuating circumstance. Late application requests will not be considered in this circumstance.

The applicant must submit a written request for consideration of a late application, together with a statutory declaration and all relevant supporting material to the Back to Work team at BTW.ProgramManagement@desbt.qld.gov.au

Applicants will be notified in writing of a decision within 60 business days from the receipt of the written request.

When applying for Back to Work support payments, it is important that your application is supported by documentary evidence that has been witnessed by an independent authorised person.

The evidence requested to support your application or later payment claim helps determine your eligibility for the program and protects applicants against potential fraud or identity theft. Documents submitted as evidence must be witnessed (i.e. certified by an authorised person) to authenticate them as true and correct at the time of submission.

The evidence documents have been chosen specifically as they should be documents that are easily accessible for most employers.

It is important to note that the original evidence document (e.g. copy of the driver licence) which has been presented to and witnessed by an independent authorised person, is a certified copy.

Witnessed copies of evidence documents are required for all initial applications for the Back to Work program.

Some evidence documents must be witnessed by an authorised person under the Oaths Act 1867.

The authorised person must visually sight the original evidence documents and check that there are no alterations to the copies presented to them. The authorised person must pay particular attention to names, dates and reference numbers.

The authorised person then endorses the copies with the following certification:

This is to certify that this is a true and correct copy of the original document, which I have sighted.

Date:

Signature of authorised witness:

Name of authorised witness:

Title of authorised witness (as per Statutory Declarations Regulations 2018):

The online application process for the Back to Work Employer Support Payment requires evidence that the employer, employee and job meet the eligibility criteria for the payment. This evidence must be submitted when making your online application.

It is important that evidence documents meet the eligibility criteria. Providing incorrect, out-of-date or illegible documents will cause delays to an application being processed.

What is required as part of my initial payment application?

All scanned items must be valid, current and legible documents and in a standard format (e.g. PDF, JPEG or Word).

Documents requiring clarification or resubmission may result in delays to the application process. Documents required at the time of application are as follows:

WorkCover Policy or Self-Insurance Information

In Queensland, under the Workers’ Compensation and Rehabilitation Act 2003 (QLD), an employer must, for each worker employed, insure and remain insured for their legal liability to pay compensation and damages to their workers.

You will be required to provide your WorkCover Policy Number and expiration date in your application. Information provided by you, about your business, including your WorkCover Policy Number, may be disclosed to WorkCover for the purposes verifying your compliance with the Workers’ Compensation and Rehabilitation Act 2003 (QLD).

If you are self-insured for workers accident and injury liability, you will be required to provide information on this insurance, inclusive of the agency who has issued your self-insurance licence.

Witnessed identification for the person submitting the application

Proof is required of the identity of the person submitting the application through QGrants. This identification must match the name and details of the person responsible in the QGrants account who is submitting the application.

Acceptable identification documents are:

- an Australian driver licence

- adult proof of age card (e.g. 18+ card)

- birth certificate

- citizenship certificate

- passport.

The identification must be current (not expired) at the date the employee commenced employment.

Witnessed ABN Certificate

All registered businesses will have received an ABN Certificate in letter form at the time of registering the business. This certificate may have been emailed to you at the time you registered for an ABN or sent to you in the mail. If you cannot locate this document, a copy of the certificate (which includes a letter) can be requested from the Australian Business Register at https://www.abr.gov.au/business-super-funds-charities/applying-abn/your-business-information-abr/paper-copies-abn-details.

The ABN and name on the ABN certificate must match the ABN and name on your QGrants organisation account and the employee payslips you provide.

All pages of the ABN Certificate must be submitted and witnessed as part of the evidence for your application.

Please note, an ASIC certificate and ABN lookups are not accepted as evidence.

Payslips

An employee must have been in paid permanent employment with you for at least four full weeks prior to the initial application being made and must have worked the average hours relevant to a part-time or full-time application.

To prove that these requirements have been met, please provide copies of the employee’s payslips for the first four continuous full weeks of thier employment with you. Payslips must be submitted as timesheets or a payroll summary will not be sufficient. The ABN and name on the payslips you provide must match the ABN and name on your ABN certificate and QGrants organisation account.

Payslips must meet the minimum requirement as set out by Fair Work Australia under the Fair Work Act 2009 and the Fair Work Regulations 2009. Information on the legal requirements for payslips is available through the Fair Work Australia website at https://www.fairwork.gov.au/pay/pay-slips-and-record-keeping/pay-slips .

Employee consent form

An employee consent form must be included with all initial payment applications submitted in QGrants.

This form must be completed and signed by the employee for whom the application is regarding.

Employee identification

Proof is required of the jobseeker’s identity. Acceptable identification documents are:

- an Australian driver licence

- adult proof of age card (e.g. 18+ Card)

- birth certificate

- citizenship certificate or

- passport.

If a non-Australian passport is being submitted as evidence, a letter issued by the Australian Government to the employee outlining their visa details must also be submitted.

The employee identification must be current (not expired) at the date the employee commenced employment. The first name, surname and date of birth on the employee identification must match the first name, surname and date of birth on the application.

Employees with a disability

If an employee has a disability and a workplace assessment to work between 8 and 20 hours per week, a signed letter issued by a Disability Employment Services Provider or Department of Human Services endorsed Job Capacity Assessment must be attached to the application. This document should detail the employee’s approved benchmark working hours, or the application will not meet the required eligibility criteria. The employee must be working in accordance with the approved benchmark working hours. If the payslips do not align with the approved benchmark working hours, the application will not meet the required eligibility criteria.

These eligible part-time jobs will attract 75 per cent of the full-time payment.

If you are waiting for evidence documents (e.g. ABN Certificate) to complete your application and it is getting closer to the cut-off date, you can still apply.

Please submit your application with the information and documents available and provide details of the documents you are waiting for as an attachment to your application. You will be contacted by a member of the Back to Work Team to discuss next steps.

Applications for Employer Support Payments are made through the QGrants system. To apply for the Back to Work Employer Support Payment you must first create an account with QGrants. Go to https://qgrants.osr.qld.gov.au/portal/. It is important to note that Back to Work Regional and Back to Work SEQ are two separate programs, so make sure you choose the program based on where the job you are offering is located.

Applications must be submitted by the employer, not an agent or other party. This is because the employer needs to agree to the terms and conditions of the Back to Work Program.

The online application form contains a series of questions employers must answer to progress the application. All questions are mandatory with the exception of employee demographic questions.

The questions on the application form address the eligibility criteria and are arranged in the following sections:

- Employer Details: addressing employer eligibility

- Employee Details: addressing employee eligibility

- Employment Details: addressing job eligibility

- Required declarations and consents.

The QGrants system requires important information to be supplied including applicant contact information, bank account details and business information. It is the responsibility of the applicant to ensure that information is kept up-to-date so that the Back to Work Team can remain in contact regarding future applications, claims and reviews.

Further information can be found on the Applying for Back to Work page.